BSP teams up with IFC to develop movable asset finance market

MANILA, Philippines — The Bangko Sentral ng Pilipinas (BSP) is partnering with the private sector arm of the World Bank Group to jointly develop a finance market that will help small businesses and agricultural entrepreneurs access credit even if a borrower has no real property to serve as collateral.

In a statement on Wednesday, the BSP said it has partnered with the International Finance Corp. (IFC) to promote movable asset finance (MAF).

MAF is an innovative lending approach that allows borrowers to secure loans using movable assets such as inventories, receivables and equipment.

This approach is designed to benefit borrowers who lack real property to serve as loan collateral, particularly those from the micro, small, and medium enterprises (MSMEs) and agricultural sectors.

The partnership

A 2022 study by the IFC showed that finance involving movable assets in the country remained under 5 percent.

Under a memorandum of understanding signed by the BSP and IFC on March 17, the partnership will focus on regulatory reform, sector capacity building and supporting services development.

The tie-up between the central bank and the World Bank Group unit will run until 2027.

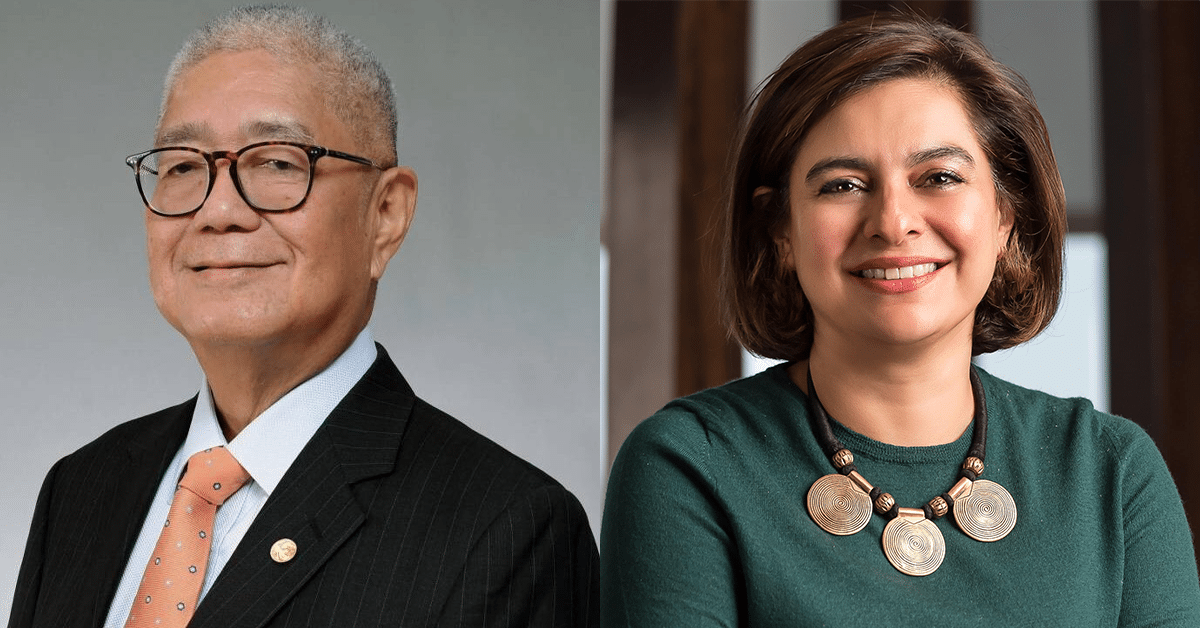

In the Philippines, IFC is now led by its country manager, veteran Pakistani banker Amena Arif.

Financial inclusion

“With this, MSMEs and agri-enterprises can use their available assets to access financing for their working capital and other needs,” BSP Governor Eli Remolona Jr. said.

For her part, BSP Deputy Governor Bernadette Romulo-Puyat added that the partnership between the BSP and IFC aligns with the vision of financial inclusion toward inclusive growth and financial resilience stated in the National Strategy for Financial Inclusion 2022-2028.

READ: Explainer: What is IFC doing in the Philippines?

Financial inclusion means that individuals and businesses have access to affordable financial products and services like credit to meet their needs.

That said, the BSP wants 70 percent of adult Filipinos to be included in the formal financial system by 2023.

The proportion of Filipinos with bank accounts reached 65 percent of the adult population in 2022.

(2025/04/18-02:30)

INQUIRER

- 04/18 13:12 ICC: Prosecution in Duterte ICC trial has until July 1 to submit evidence

- 04/18 08:42 How Bantayan Island got a Vatican pass to eat meat during Holy Week

- 04/18 02:30 BSP teams up with IFC to develop movable asset finance market

- 04/17 22:04 Duterte’s ICC battle heats up ahead of trial

- 04/17 21:42 PH reelected VP of United Nations Tourism General Assembly

- 04/17 15:05 Holy Week travel: Couple fulfills dream of visiting nurse mom in UK

- 04/17 13:01 US congressional delegation reaffirms support to PH-US alliance

- 04/17 06:20 Videos, photos, 8,000 pages: More evidence vs Duterte

- 04/17 06:20 Videos, photos, 8,000 pages: More evidence vs Duterte

- 04/17 06:05 US approves sale of training choppers to PH

- 04/16 12:26 PPA: Passengers at seaports could exceed 1.7 million this Holy Week

- 04/16 10:53 Moody’s upgrades PNB rating, sees downgrade risk for Security Bank

- 04/16 10:26 PCG launches search for 10 missing crew of Chinese ship

- 04/16 10:13 DoubleDragon to buy 35% of MerryMart in P1.28-B deal

- 04/16 10:12 Marcos approval, trust ratings fall; Sara Duterte's numbers rise

- 04/16 05:50 ‘West Philippine Sea’ prominence on Google Maps cheered

- 04/16 05:45 Tests show underwater drones found in PH likely from China

- 04/16 04:45 86 aliens working for scam hub nabbed in Makati

- 04/15 22:59 More celebrate WPS label on Google Maps: Victory for PH

- 04/15 11:58 US anti-ship missile NMESIS now in PH as ‘security anxiety’ looms

- 04/15 11:15 Woman skipper keeps China ‘bullying’ off Scarborough at bay - PCG

- 04/15 11:08 PH remittance growth slowed in Feb to 2.7%

- 04/15 08:30 PEZA courts more South Korean investors

- 04/15 05:30 ‘Bayanihan’ spirit alive among Filipinos in quake-hit Myanmar

- 04/14 23:11 PCG’s BRP Gabriela Silang makes Vietnam port call

- 04/14 16:50 Former PCSO GM Garma seeking US asylum, says lawyer

- 04/14 13:14 Let’s stand up against bullies, Marcos says of ‘crazy’ vlogger Vitaly

- 04/14 11:34 Megawide raises P5.3B from preferred shares offer

- 04/14 11:08 Explainer: Harry Roque’s asylum bid and why many oppose it

- 04/14 05:25 Naia operator decides to relocate Terminal 4

- 04/14 05:20 Comelec starts 1st overseas online vote

- 04/14 02:05 Jollibee braces for ‘indirect’ Trump tariff impact

- 04/14 02:04 Gov’t debt service bill down by 82% in Feb to P52.2B

- 04/11 13:58 Palace says Marcos in the pink of health, asks netizens not to speculate

- 04/11 12:18 PNP chief Marbil mobilizing assets to stop Chinese kidnapping cases

- 04/11 11:32 Vivian Que Azcona: Remembering a quiet visionary

- 04/11 09:32 Foreign direct investments fall 20% in January

- 04/11 05:50 Jobs, health, food still top voter concerns

- 04/11 05:36 ICC warrant legal, gov’t way of yielding Duterte ‘not’ – Azcuna

- 04/11 05:30 Anson Que slay third kidnap case in 5 weeks – group

- 04/11 02:40 BSP cuts policy rate by 25 bps to 5.5%

- 04/11 02:22 BMI: Trump tariffs may ‘reverse’ Philippine efforts to contain deficit

- 04/11 02:20 After five-year hiatus, PAL reopens aviation school

- 04/10 15:44 Passengers, crew of flight PR 102 diverted to Japan airport disembark

- 04/10 15:38 Azcuna: Abuse in Duterte arrest may be raised in ICC

- 04/10 15:31 Lawmaker to vlogger held for contempt: Do you still have honor?

- 04/10 15:15 Economic czar Frederick Go off to the US for tariff dialogue

- 04/10 15:03 BSP resumes easing cycle amid tariff-led global headwinds

- 04/10 09:54 Defending West Philippine Sea: The abyss separating Duterte, Marcos

- 04/10 05:48 Telco operators not keen on in-person SIM card registration

- 04/10 05:42 Another Chinese research ship sighted off Cagayan

- 04/10 05:34 Asean to discuss united response to ‘Liberation Day’

- 04/09 17:06 DTI chief to meet Asean counterparts over Trump tariffs

- 04/09 13:59 1 of 4 Filipinos missing in quake-hit Myanmar found dead – DFA

- 04/09 10:31 DILG to pilot-test infra audit tool to prepare for the ‘Big One’

- 04/09 05:45 6 nabbed in foiled attempt to rescue crime gang ‘boss’

- 04/08 17:40 Transporter named ‘Alias Batman’ behind escape try of Chinese Pogo hands

- 04/08 16:12 PH Navy receives first guided-missile corvette

- 04/08 15:28 Solons: Facebook’s lack of PH office makes it hard to address fake news

- 04/08 14:51 PCCI warns of economic fallout from US tariffs, urges swift government action

- 04/08 14:50 Palace airs concern over recent China aggression in Bajo de Masinloc

- 04/08 12:42 Palace suggestion: Invite int’l lawyers to Senate's Duterte arrest probe

- 04/08 11:32 ‘Specialized teams’ to protect journalists for 2025 polls

- 04/08 11:26 Australia donates ₱34M worth of drones, training to PH Coast Guard

- 04/08 10:52 New lawyer joins Rodrigo Duterte’s ICC defense team

- 04/08 06:06 PCG challenges Chinese ship amid ‘Cope Thunder’ drills

- 04/07 20:53 Sociologist sounds alarm on bets’ ‘normalization’ of discriminatory remarks

- 04/07 14:43 Substandard steel, deadly risks: Bangkok collapse a warning for PH

- 04/07 13:25 Palace not yet sure if arrest of 3 Filipinos in China retaliatory

- 04/07 13:25 House checks if OVP, DepEd secret fund recipients actually got the money

- 04/07 11:38 Qatar frees 17 Filipinos arrested for unauthorized rally

- 04/07 10:56 Russian vlogger makes ‘L’ sign, seizes cop’s hat during presser

- 04/07 05:55 Chinese vessel in near collision with PCG ship

- 04/07 05:45 Lawmaker: VP can no longer stay silent about P612.5M

- 04/07 05:00 Groups renew lobby vs tobacco products

- 04/07 04:50 New F-16 jets may arrive 2026

- 04/04 14:05 DMW on alert, ready to aid Taiwan OFWs

- 04/04 12:46 Concerned about US tariffs, MAP urges creation of economic security council

- 04/04 08:30 Wholesale prices of goods in the Philippines slightly up in February

- 04/04 05:48 Trust a factor: More women than men convicted for child abuse since 2019

- 04/04 05:42 China research ship crew tells PCG: We’re going fishing in Indian Ocean

- 04/04 05:32 Palace plays down AFP preps for China invasion of Taiwan

- 04/04 05:30 China arrests 3 Filipinos for alleged spying

- 04/04 02:30 Philippines seen to weather US tariff shocks

- 04/03 12:30 Procurement of F-16 fighter jets for PH defensive posture - Bersamin

- 04/03 11:46 Palace: Despite call for troops, PH not heading to war in Taiwan Strait

- 04/03 09:59 Trump sets 17% tariff on Philippine goods coming to America

- 04/03 08:40 Russian vlogger faces deportation after harassing Filipinos in BGC

- 04/03 05:44 American author Nicholas Kaufmann pleads: ‘I’m not Duterte’s lawyer’

- 04/03 05:42 Rights watchdog slams online ‘dirty tactics’ vs drug war victims’ kin

- 04/03 05:34 China urges PH: Don't play with fire on Taiwan issue

- 04/03 05:30 US approves $5.58-B sale of 20 F-16 fighters to PH

- 04/02 13:51 DA revising minimum access volume rules for pork imports

- 04/02 13:46 Palace: No need to worry over AFP alert on Taiwan situation

- 04/02 12:10 SEC exempts certain funds from single business group limit

- 04/02 10:54 House prosecution team in Sara Duterte impeachment trial 80% ready

- 04/02 07:59 Kaufman, not Kaufmann - author mistaken as Duterte's lawyer

- 04/02 05:50 PH team arrives in Myanmar for two-week deployment to help quake victims

- 04/02 05:45 PH help sought for Filipinos held in Trump immigration sweep

- 04/02 05:15 AFP chief tells troops: Be ready if Taiwan is invaded

- 04/01 23:27 15 Philippine tycoons led by Villar among Forbes 'World's Richest People'

- 04/01 14:40 OCD warns: Substandard steel puts lives at risk if ‘The Big One’ hits Metro Manila

- 04/01 12:19 Duterte camp scrambling to stop ICC trial before it starts – lawyer

- 04/01 11:05 Naval revamp on West PH Sea will increase coordination – Tolentino

- 04/01 10:02 Philippines deploys search and rescue team to quake-hit Myanmar

- 04/01 07:31 Ex-President Gloria Arroyo opens up about family’s health ordeal

- 04/01 05:30 BI seeks penalties for Filipinos exiting PH through ‘backdoor’

- 04/01 05:30 Lack of ICC jurisdiction ‘rehashed’ issue – lawyers

- 04/01 02:18 ‘Trojan’ phone attacks may cause Pinoys to lose P86B

- 04/01 02:13 BSP pegs March inflation at 1.7% to 2.5%

- 03/31 14:02 Alex Eala rises to world No. 75 in WTA rankings

- 03/31 13:46 PNP eyes lifetime ban on firearms use for gun ban violators

- 03/31 05:55 Gov’t extends aid to Duterte ralliers arrested in Qatar

- 03/31 05:45 4 Filipinos missing in Myanmar – DFA

- 03/31 05:40 Timor-Leste stakes Asean bid over fugitive ex-lawmaker

- 03/31 05:40 Navy prepares to revamp West Philippine Sea order of battle

- 03/31 05:35 Ortega: VP fund recipients like grocery list

- 03/31 02:07 US tariffs seen dragging down PSEi

- 03/31 02:04 ‘Tailored’ reforms to cure PH learning poverty urged

- 03/30 05:12 China tells PH: Stop ‘provocations’ in WPS involving US

- 03/28 14:47 US defense chief's visit an assurance at a critical time - Romualdez

- 03/28 14:43 DND neither confirms nor denies deployment of another Typhon missile

- 03/28 13:14 Activists wish more birthdays for Duterte so he can see trial’s end

- 03/28 05:50 BI: Foreigners able to set up firms after faking PH citizenship

- 03/28 05:48 Poe: Print media remains vital amid flood of fake news

- 03/28 05:36 Chided by VP Duterte, AFP stresses rule vs political partisanship

- 03/28 05:30 Malacañang to Magalong: What ‘election funds’?

- 03/27 16:33 Palace on Duterte’s arrest: Nothing personal

- 03/27 15:47 Palace to China: ‘PH is no one's chess piece’

- 03/27 13:23 Duterte death in detention may lead to VP Sara presidency – Panelo

- 03/27 13:19 ICTSI urges public caution over deepfake scam involving Razon

- 03/27 12:03 Duterte drug war: Thousands killed, menace stayed alive

- 03/27 05:52 US ‘reestablishing deterrence’ amid Chinese aggression in SCS

- 03/27 05:50 NBI: Foreign ‘spies’ used drones to monitor PH, US naval assets

- 03/27 05:40 Sen. Imee Marcos leaves bro’s Alyansa ticket, cites Duterte arrest

- 03/27 05:34 Zero-remittance week? Enrile warns pro-Duterte OFWs

- 03/27 05:30 ‘181 items’: ICC prosecutor’s body of evidence vs Duterte

- 03/27 05:06 Maguindanao poll exec, husband slain in ambush

- 03/26 23:25 Online petition vs Roque’s asylum request gets over 21,000 signatures

- 03/26 13:47 Duterte backers' 'zero remittance' to hit economy, families - Escudero

- 03/26 12:11 Escudero won’t summon Duterte on impeach raps: It can’t legally be done

- 03/26 11:42 Duterte ICC case progresses: First set of evidence submitted

- 03/26 10:09 176 Filipino human trafficking victims repatriated from Myanmar – DFA

- 03/26 09:55 Current Senate can oust VP Duterte in just 43 days – Colmenares

- 03/26 05:55 Duterte kin press habeas petition, cite OSG recusal

- 03/26 05:45 AFP on possible arrival of second Typhon: The more the merrier

- 03/26 05:30 Paolo Duterte tells House he’ll go to 16 countries in 2 months

- 03/26 04:45 Refusal to extradite Teves can affect Timor-Leste’s bid to join Asean

- 03/25 14:35 Duterte assets: Palace says no commitment if ICC issues freeze order

- 03/25 13:52 Beijing’s reiteration of South China Sea claim 'joke' – PH Navy

- 03/25 12:45 2025 war games between US, PH Air Force set for April – PAF

- 03/25 12:14 Sen. Bato dela Rosa’s security detail recalled after Duterte’s arrest

- 03/25 05:55 Respect rights in ‘fake news’ fight, gov’t urged

- 03/25 05:35 China ‘challenges’ PH, US aircraft as joint drills begin

- 03/25 05:15 UP develops natural, safer remedy for gout

- 03/25 04:35 ‘Slam slayer' Alex Eala gives Filipino tennis hopefuls a reluctant hero

- 03/25 02:09 Philippines, Japan ink 5 loan deals worth P65B

- 03/25 02:07 MPIC nears P1-B Franklin Baker buyout

- 03/24 13:36 Harry Roque seeking asylum to avoid further Pogo questioning – Palace

- 03/24 11:54 CHR: Free speech has limits, but gov’t must not infringe on it

- 03/24 10:50 ICC sets April deadline for Duterte case evidence disclosure

- 03/24 05:55 Transport groups split over modernization

- 03/24 05:40 Writer leads petition vs Roque asylum bid

- 03/24 05:39 PH revives Sabah claim in note to United Nations

- 03/24 04:50 List of alleged VP fund recipients gets stranger

- 03/24 02:08 US startup to build nuclear ‘micro’ reactor in PH

- 03/22 05:32 Vloggers apologize in House under intense grilling in ‘fake news’ probe

- 03/21 12:39 Rodrigo Duterte’s arrest being ‘warrantless’ false – lawyer

- 03/21 05:40 More suspected spies nabbed in Subic raid

- 03/21 05:32 Imee Marcos blasts Duterte arrest; administration execs push back

- 03/21 05:30 Timor-Leste court rejects PH bid to extradite Teves

- 03/21 02:30 Philippine creative economy took a hit in 2024 – PSA

- 03/21 02:26 SMC seeks P34-B relief from soured Meralco deal

- 03/21 02:24 AboitizPower earmarks P78B for expansion this year

- 03/20 14:33 Chinese tech firm Dobot shows Atom robot chef serving breakfast

- 03/20 12:27 AFP highlights the urgent need for stronger cyber resilience

- 03/20 10:56 NVIDIA CEO declares ‘the age of generalist robotics is here’

- 03/20 10:30 Senate starts probe of Rodrigo Duterte’s arrest

- 03/20 08:41 Bato dela Rosa, et. al: Cast of characters in Duterte drug war

- 03/20 05:44 Dela Rosa changes tune: ‘Why will I surrender?’

- 03/20 05:42 PH ranks 3rd country in Asia for ‘unusual heat’

- 03/20 05:30 Foreigners to defend Duterte; Roque out, says VP

- 03/20 02:30 February auto sales growth eased to 2.9%

- 03/20 02:28 Philippines swings back to dollar surplus

- 03/19 23:56 Japanese gov’t to send observers in BARMM for 2025 polls – Comelec chief

- 03/19 14:42 DICT pushes for digital reforms in government processes

- 03/19 05:55 DOJ to SC: Duterte kin’s habeas petitions moot

- 03/19 05:40 Recaptured Korean says he paid P14M to escape BI custody

- 03/19 05:20 PH Navy to flex anti-ship missiles in next ‘Balikatan’

- 03/19 04:30 P100,000 reward up for info on killers of Boracay tourist

- 03/19 02:14 Gov’t sues firm over P2.37-M illegal onion imports

- 03/19 02:10 BSP less optimistic about 2025, 2026 PH growth

- 03/19 02:09 ‘Political noise’ on mute for developers

- 03/18 12:39 'Duterte arrest shows ICC can go after Putin, Netanyahu'

- 03/18 09:42 Cop under probe for social media posts on Duterte’s ICC arrest

- 03/18 09:31 China’s Baidu launches free AI models to rival DeepSeek

- 03/18 08:31 Gov't may hire own lawyer in defending Duterte ICC arrest – Palace

- 03/18 05:55 SolGen wants no part in Duterte petitions in SC

- 03/18 05:50 Escudero: Dela Rosa to get Senate ‘courtesy’ if arrested

- 03/18 05:45 Spike in hate content seen after Duterte arrest

- 03/18 05:25 Roque to seek political asylum in the Netherlands

- 03/18 02:13 BSP flags impact of looming Naia fee hikes on inflation

- 03/18 02:03 ‘Political unrest’ may delay key reforms, says ING Bank

- 03/17 17:56 Duterte’s ICC arrest: Separating fact from lies

- 03/17 10:07 Marcos told to rejoin ICC as PH marks 6th year of treaty pullout

- 03/17 05:55 Duterte arrest petition cites dela Rosa’s role in drug war

- 03/17 05:45 Time gap crucial for Rodrigo Duterte lawyers to ready defense

- 03/17 05:35 Hometown supporters demand ex-president’s return

- 03/17 02:40 Gov’t debt service bill rose 26% in 2024

- 03/15 15:13 Google Gemini app offers new free AI-powered features

- 03/14 12:05 Doubled bank deposit insurance of P1M to take effect on March 15

- 03/14 10:47 Rodrigo Duterte wants Medialdea as legal counsel in ICC trial

- 03/14 10:44 President’s office paid for plane that took Duterte to The Hague – Remulla

- 03/14 07:20 West PH Sea: When diplomatic protests vs China fail

- 03/14 07:00 Where Duterte awaits trial: A look at the ICC detention center

- 03/14 05:48 Navy sends ship to Batanes to deter foreign poachers

- 03/14 05:04 Senate blue ribbon body to probe bridge collapse in Isabela

- 03/14 02:30 Fitch upgrades ‘viability rating’ of 5 leading Philippine banks

- 03/13 16:56 Siquijor on the map: A rising star in PH tourism

- 03/13 10:14 Philippine, Slovenian firms strengthen ties with new biz agreement

- 03/13 10:10 Bato dela Rosa, Oscar Albayalde next on ICC arrest list?

- 03/13 09:33 Adaptive LiDAR research may enable autonomous farming robots

- 03/13 07:42 PH Embassy in The Hague gives assistance to Duterte and companions

- 03/13 02:30 BSP braces for ‘arms race’ vs cybercriminals

- 03/13 02:28 Traders fret more over US tariffs than Philippine politics

- 03/12 23:36 No political instability as Duterte arrest is legal – House reps

- 03/12 16:37 GCash sets transaction limits to curb vote buying in 2025 polls

- 03/12 14:23 Sony is experimenting with AI-powered video game characters

- 03/12 13:53 Forget people power; study ICC case instead – Palace to Duterte backers

- 03/12 13:10 Metro Pacific 2024 core earnings hit record high P23.6B

- 03/12 08:40 7-year Treasury bond rate climbs on political noise

- 03/12 02:10 Duterte arrest, fears of ‘political instability’ wipe out PSEi gains

- 03/12 00:04 Marcos: Arrest of Duterte not ‘political persecution’

- 03/11 17:21 The fall of 'The Punisher': Rodrigo Duterte’s path to the ICC

- 03/11 14:46 19 Chinese vessels monitored in West PH Sea in February - Navy

- 03/11 13:11 Ex-President Duterte cries illegal detention, questions ICC warrant

- 03/11 13:07 EXPLAINER: What’s next after arrest of Rodrigo Duterte?

- 03/11 11:10 Palace confirms arrest warrant from ICC for Rodrigo Duterte

- 03/11 09:43 Deepgram launches Nova-3 Medical AI for medical transcription

- 03/11 09:12 Manus: China creates world’s first fully autonomous AI agent

- 03/11 07:44 NTC looks into requiring personal appearance for SIM card registration

- 03/11 05:40 Manila to Beijing: PH a ‘sovereign state’

- 03/11 05:20 Pagasa buying new gear for heat index monitoring

- 03/11 02:10 Naia braces for 30% rise in passenger volume

- 03/10 19:25 China's wordplay won't mask West PH Sea issue – DFA

- 03/10 12:19 Colmenares: Duterte can seek asylum in China as ICC arrest warrant looms

- 03/10 11:17 FDIs missed 2024 forecast amid uncertainties — BSP

- 03/10 05:55 Gov’t ‘obliged to follow’ Interpol on Rodrigo Duterte arrest

- 03/10 05:50 Rodrigo Duterte to Hong Kong supporters: ‘If I’m detained, so be it’

- 03/10 05:10 Lawmaker seeks probe of Chinese shore leaseholds

- 03/10 02:05 MPTC earmarks P35-B funding for expansion plans in 2025

- 03/10 02:01 Recycling firm in ‘Ponzi scheme’ loses SEC registration

- 03/08 19:00 Employers seek flexibility to prevent heat stress this summer

- 03/07 10:30 PH, Paraguay to strengthen trade, investment ties

- 03/07 10:18 DA bans poultry importation from 3 US states due to bird flu

- 03/07 08:09 January credit growth hit 2-year high

- 03/07 05:36 Beware of Chinese ‘lies’ claiming Palawan – PH maritime council

- 03/07 05:34 Palawan imposes 50-year mining moratorium

- 03/07 05:30 Palace exec: Better check bridges built under Duterte admin

- 03/07 02:26 World Bank lends $1B for health care, Mindanao highways

- 03/06 14:31 Act vs drinking, smoking, vaping ‘epidemic’ among youth, poll bets told

- 03/06 12:40 DA lifts ban on poultry products from France

- 03/06 10:52 Ayala to sell 40% of logistics arm to AP Moller Group

- 03/06 06:01 US approves 1st fast-acting insulin biosimilar for diabetes

- 03/06 05:55 Hontiveros scores BI over Pogo ‘deportation gone wrong’

- 03/06 05:50 Resupply mission to Ayungin troops completed without Chinese harassment

- 03/06 02:32 Filipinos gain appetite for business class flights

- 03/05 21:38 ICTSI’s Ecuador port terminal enters Latin America-Asia trade loop

- 03/05 15:01 Lawmakers pursuing 'missing link' in Alice Guo's escape

- 03/05 14:29 PAF’s FA-50 fighter jets grounded following Bukidnon crash

- 03/05 13:55 The state of AI in Philippine education and its future

- 03/05 05:40 DepEd mulls changing class skeds to better cope with heat

- 03/05 02:10 Local producers call for curb on salt imports

- 03/05 02:08 Philippines seen to reduce rice imports this year

- 03/04 15:57 West PH Sea: Navy slams ‘absurd, baseless’ China social media claim on Palawan

- 03/04 12:16 PSE earnings surged 57% to P1.2B in 2024 on PDS stake measurement

- 03/04 11:14 Philippine Air Force fighter jet with two pilots goes missing

- 03/04 08:15 High heat index prompts face-to-face class suspensions on Tuesday, March 4

- 03/04 05:55 Heat index hits ‘danger’ levels in parts of Luzon

- 03/04 05:50 PH envoy: Defense is each country’s call

- 03/04 05:35 Palace looking into China-donated gear

- 03/04 02:10 PH factory activity ‘moderated’ in February 2025

- 03/03 11:13 BCDA, South Korean firms eye New Clark City complex

- 03/03 10:35 Escudero backs Pimentel’s push to help draft VP impeachment trial rules

- 03/03 09:00 Saints and sinners: Triumphs, scandals, and wars of the papacy

- 03/03 07:43 How to start using AI agents for your business

- 03/03 05:55 Escudero eyes local online gambling ban

- 03/03 05:45 BI: Chinese arrivals at 500,000, 20% rise from 2023

- 03/03 05:35 Navy to take delivery in April of first of 2 South Korean-made corvettes

- 03/03 05:15 Gov’t urged to monitor foreign meddling in polls

- 03/03 02:11 $283.7M in ‘hot money’ fled PH in January

- 03/02 23:02 ‘Danger’ level of heat index to hit 2 Luzon areas

- 02/28 15:30 GPT-4.5: OpenAI’s ‘largest and most knowledgeable model yet’

- 02/28 13:46 Calabarzon has most dengue cases in PH at 10,000 – DOH

- 02/28 12:58 Peza, Japan firm sign registration contract for Laguna facility

- 02/28 09:45 DepEd, Microsoft promote AI adoption in Philippine education

- 02/28 07:31 PDIC doubles deposit insurance to P1M

- 02/28 05:48 Teodoro urges Asean to unite vs SCS ‘violations’

- 02/28 05:46 Palace security tighter after arrest of 5 ‘spies’

- 02/28 05:34 Comelec may still change its rules on survey firms

- 02/27 13:39 NGCP feels ‘vindicated’ after arbitration case win

- 02/27 13:25 Trafficker imprisoned for life for online child sexual abuse

- 02/27 05:52 Beijing told: Stop comments on PH defense decisions

- 02/27 05:38 PhilHealth hikes coverage for heart procedures

- 02/27 05:32 Hontiveros: President should consider suspending all online gaming

- 02/27 05:30 DILG tags Pogo ‘syndicate’ in Chinese teen’s kidnapping

- 02/27 02:34 PH GDP growth seen picking up pace in 2025

- 02/26 15:23 Accenture shares findings on APAC’s responsible AI readiness

- 02/26 13:51 Hontiveros warns of neglect if Senate delays Sara Duterte impeachment

- 02/26 12:04 PCG joins research efforts, mapping of reef restoration sites in West PH Sea

- 02/26 11:23 PNP: Father of abducted Chinese teen has Pogo connections

- 02/26 11:21 Helport enhances debt collection in the Philippines with AI

- 02/26 05:55 SC justice: PhilHealth funds not for other uses

- 02/26 05:10 NBI agents nab 2 more Chinese ‘spies,’ 3 Pinoys

- 02/26 05:00 House, Senate have 10 days to reply to VP Duterte impeachment complaint

- 02/25 12:23 Escudero sees diplomacy as only solution to China issues

- 02/25 10:56 PH hopes for more US military aid despite global aid freeze – Romualdez

- 02/25 05:55 PH, Japan boost security ties amid rise of China

- 02/25 05:45 US security assistance to Manila exempted from aid freeze

- 02/25 05:12 Declassified docs detail US monitoring of PH during Edsa Revolt

- 02/25 05:05 Teachers ask Congress to probe ‘ghost students’ in DepEd program

- 02/25 02:12 Maharlika ventures into mining, extends loan to Makilala

- 02/24 23:49 Miss Universe judge accuses Anne Jakrajutatip of trying to rig pageant results

- 02/24 13:44 Cebu Pacific goes full AI with customer support

- 02/24 12:22 Marcos told: Call special Congress session to start Duterte impeachment

- 02/24 09:31 Feb 25 school holidays: Protesting ‘distortion of history’

- 02/24 05:55 Duterte ‘one-man fake news factory’ – Palace

- 02/24 05:50 France flexes aircraft carrier in WPS patrol

- 02/23 22:55 France awaits PH response on submitted first draft of VFA

- 02/21 13:29 PAGASA, CAAP see collaboration with Hong Kong Observatory

- 02/21 09:58 DICT launches first drone-assisted medicine delivery in SEA

- 02/21 09:29 South Korea builds world’s largest data center worth $35 billion

- 02/21 06:53 Elon Musk launches Grok 3, the ‘smartest AI on Earth’

- 02/21 05:52 PH makes first frozen durian shipment to China

- 02/21 05:46 PH, NZ closer to signing deal on visiting forces

- 02/21 05:30 House members assert: ‘Impeach’ rule followed

- 02/21 02:10 Grooming the Philippines as a professional services hub

- 02/20 23:57 School lectures, research facility on West Philippine Sea eyed

- 02/20 23:07 Solon on VP Duterte impeachment: 1-year ban hasn't set in

- 02/20 11:32 Impeachment trial vs VP Duterte can start by March, says Pimentel

- 02/20 10:56 West PH Sea: US slams China’s ‘dangerous’ maneuvers in Scarborough Shoal

- 02/20 09:35 Lower tariff for pork imports eyed to cut prices

- 02/20 07:39 DeepSeek on wheels: Chinese EV firms install AI into vehicles

- 02/20 05:50 PMA questions delay in dengue vax approval

- 02/20 05:42 Cost of new Senate building to reach P31B – Escudero

- 02/20 05:34 DepEd: P52M almost went to ‘ghost students’ in 12 private schools

- 02/20 05:32 What ‘clamor’? Escudero asks amid calls to start trial ‘forthwith’

- 02/20 05:30 VP Duterte makes own move at SC vs impeachment

- 02/20 05:04 Baguio braces for influx of tourists for Panagbenga

- 02/19 11:02 VP Sara Duterte files petition at SC to stop impeachment moves against her

- 02/19 10:23 Nationwide crime rate drops by 26% from Jan 1 to Feb 14, says PNP

- 02/19 10:23 Sara Duterte conviction, acquittal at Senate hinges on poll results

- 02/19 08:30 Scam Watch Pilipinas urges public to report hacked FB accounts

- 02/19 05:55 Duterte allies ask SC: Stop VP impeachment trial

- 02/19 05:40 Pimentel to Escudero: Senate’s duty to start trial ‘without any delay’

- 02/19 05:40 Chinese PLA Navy chopper gets as close as 3 meters to BFAR plane

- 02/19 02:06 PH imported 20.8% more pork, beef in 2024

- 02/18 13:38 Marcoleta grills Tarriela after backlash on ‘no such thing’ as WPS quip

- 02/18 08:41 New York Times adopts generative AI tools for journalists

- 02/18 05:55 Rodrigo Duterte faces sedition rap for ‘kill senators’ quip

- 02/18 05:45 Over 70 groups to hold protest rally on Edsa anniversary

- 02/18 05:00 SC may tackle petition for ‘immediate’ VP Duterte impeachment trial

- 02/18 02:10 Remittances hit new record high of $34.49B in 2024, up 3%

- 02/17 06:51 Perplexity AI launches Deep Research feature for free

- 02/17 05:55 Manalo asserts PH rights, internationl law in Munich forum

- 02/17 05:50 PCG ships in ‘David vs Goliath’ face-off in West Philippine Sea

- 02/17 05:45 Brawner, German counterpart discuss ‘military cooperation’

- 02/17 05:25 ‘Negative campaigning’ allowed but keep it ‘classy’

- 02/17 02:05 PH financial system’s resources cross P33 trillion

- 02/16 14:36 Reps: Rodrigo Duterte’s threats to kill not aligned with Filipino values

- 02/16 13:16 NBI urged to probe Duterte’s joke on killing 15 senators

- 02/16 05:48 Coffee lovers in for a pricey jolt

- 02/16 02:12 PH miners strike gold as global prices skyrocket

- 02/15 02:20 PH banking system saw record profit in 2024

- 02/14 13:41 PAOCC rescues 35 foreigners kidnapped by Pogo

- 02/14 11:01 PH never promised China it would withdraw US Typhon missile – NSC

- 02/14 06:59 Instructure survey shows PH demand for lifelong learning, tech

- 02/14 05:50 PH eyes sea drills with France, Italy, UK

- 02/14 05:42 PH mulls private, foreign funding for military modernization

- 02/14 05:40 US aid freeze affects P15 billion worth of DOH, DepEd projects

- 02/14 05:30 Duterte hits back at Marcos to push PDP-Laban bets

- 02/14 02:32 In surprise move, BSP keeps key rate steady

- 02/13 13:55 Pinoy scientists make transparent aluminum via acid droplets

- 02/13 11:04 Filipinos warned: Beware of visa scams as peak travel season nears

- 02/13 10:20 BCDA to bid out Camp John Hay golf club management

- 02/13 09:49 Movement of China's research vessel off Luzon 'suspicious' – Tarriela

- 02/13 09:36 29 PH firms make it to Time's best companies in Asia-Pacific

- 02/13 08:04 Global warming can become too hot for seniors in many areas, says a study

- 02/13 05:42 Extreme weather study says PH 10th hardest hit

- 02/13 05:40 FDA orders recall of antibiotics drug used vs pneumonia, bronchitis, UTI

- 02/13 05:36 Kontra Daya: Over half of party lists don’t represent poor

- 02/13 05:04 DOT backs grassroots tourism in Cordillera with village grants

- 02/13 02:20 Investors seek nod for fresh 7,500 MW of renewables capacity

- 02/12 11:22 NBI files criminal cases vs Sara Duterte for threatening Marcos

- 02/12 09:56 House lawmaker pushes for digital literacy in basic education

- 02/12 09:37 AI chatbots can’t summarize news accurately, says BBC study

- 02/12 06:42 PhilSA warns public of fallen debris as China launches rocket into space

- 02/12 05:55 Marcos slams Duterte, but bets avoid ‘VP trial’ talk

- 02/12 05:40 Makabayan bets: If we win, we’ll vote to convict impeached VP Duterte

- 02/12 05:20 Margarita Forés, chef, restaurateur, Filipino cuisine advocate; 65

- 02/11 23:45 PCG vessel thwarts Chinese ship approaching Zambales coastline

- 02/11 18:34 Lured to work in ‘scam centers,’ Filipinos pay for freedom or escape

- 02/11 17:39 PCG: How can world back West PH Sea term if we undermine it?

- 02/11 08:03 Interest rate jitters spook investors

- 02/11 07:01 Google AI Mode has reportedly started internal testing

- 02/11 05:55 VP’s bank records eyed as House preps for impeachment trial

- 02/11 05:50 Midterm poll campaign begins for national candidates

- 02/11 05:45 PH bet Dia Mate is Reina Hispanoamericana 2025

- 02/11 05:45 PH bet Dia Mate is Reina Hispanoamericana 2025

- 02/11 02:10 Trump 2.0 sank PH foreign direct investments in Nov 2024

- 02/10 22:08 Chua: We’re not rushing Senate, but Constitution says ‘forthwith’

- 02/10 14:17 China fisheries research ship spotted in PH archipelagic waters

- 02/10 09:13 Man professes love for ChatGPT, receives surprising reply

- 02/10 05:55 Carpio: Special session possible for GAA, VP trial

- 02/10 05:45 Australian police warn vs PH-based ‘love’ scams

- 02/10 05:30 Beijing ‘shocked’ by ‘Chinese spies’ fear of US Embassy staff

- 02/10 05:25 PH, New Zealand eye military deal soon amid China concerns

- 02/10 05:20 Expert reminds public: 20% of flu cases fatal

- 02/10 02:09 PH dollar reserves dipped to 9-month low in January

- 02/09 05:30 Drilon to Marcos: Call special session now

- 02/07 08:39 How to repurpose your old phone as other gadgets

- 02/07 07:45 Mitsubishi Motors to invest P7B in PH until 2030

- 02/07 05:55 English-only policy must be addressed – UP Sentro ng Wikang Filipino

- 02/07 05:36 SWS survey: 59 percent of Pinoys affected by surging rice prices

- 02/07 05:30 No Senate trial of VP Duterte before June – Escudero

- 02/06 18:19 BI warns against travel agencies engaged in illegal operations

- 02/06 14:37 Digital 2025 report shows the latest global online trends

- 02/06 14:29 NEA, DOE to install solar power at far-flung schools

- 02/06 12:27 DA authorizes importation anew of 4,000 MT of red and white onions

- 02/06 11:01 No impeachment trial vs VP Duterte during break of Congress – Escudero

- 02/06 09:48 Joblessness dips in December 2024 – PSA

- 02/06 08:13 How to avoid getting flagged by AI checkers

- 02/06 05:38 US aid freeze affects 5 DepEd projects

- 02/06 05:30 Sara Duterte impeached; House gets 215 to sign

- 02/06 02:24 Laguna hydro power plants up for outright sale

- 02/05 23:46 ‘Monster ship’ still in WPS as PH patrols with US, Japan, Australia

- 02/05 09:26 January inflation steady at 2.9% as rice price growth hits over 4-yr low

- 02/05 08:02 DoubleDragon offers 7.77% rate for 7-year bonds

- 02/05 07:38 US OKs copyright for AI-made media, sees AI as creative tool

- 02/05 05:50 SC justice: PhilHealth prioritized investments, not benefits

- 02/05 05:45 Vloggers question House ‘fake news’ probe at SC

- 02/05 05:35 Teachers had to catch up with ‘Catch-Up Fridays’

- 02/04 21:50 Tarriela slams Marcoleta over West Philippine Sea remarks

- 02/04 10:59 2 China vessels off Pangasinan exit PH exclusive economic zone

- 02/04 07:25 Venice AI: The free, uncensored and private ChatGPT alternative

- 02/04 07:20 How AI in construction sites brings productivity and efficiency

- 02/04 05:40 China denies hacking phone of PH envoy to US

- 02/04 05:35 It’s time to take the heat seriously, experts warn

- 02/04 04:55 SWS trust ratings for Marcos, Duterte continue to drop

- 02/04 02:11 BSP eyes shift away from OTPs to fight fraud

- 02/04 02:06 P12.4-B Pampanga solar farm marked as priority program

- 02/03 15:54 China endangering global health, security – ex-US security exec

- 02/03 14:40 WPS: Coercive acts persist despite PH win at The Hague – Romualdez

- 02/03 08:33 Catholic Church releases AI guidelines for labor, warfare, etc.

- 02/03 05:55 Clergy’s call: Go beyond ‘ayuda-driven budget’

- 02/03 05:45 ‘Spies’ were PH residents for decades – BI

- 02/03 02:06 Emperador takes over premium liquor maker in Mexico

- 02/03 02:03 New high: PH vehicle sales seen to top 500,000 this year

- 02/02 12:10 PCG dispatches vessels to drive away 2 Chinese ships in West PH Sea

- 02/02 05:42 SWS: Jobs, food and health top Filipinos’ main concerns

- 02/02 05:02 Agri chief urges steps to avert egg shortage

- 02/02 02:18 ‘Secret Ingredient’: Innovative funding for Pinay-led drama awes Cannes

- 02/01 09:50 CICC gets 10,000 complaints vs online scams in 2024, tripling past year's list

- 01/31 14:29 Scam Watch Pilipinas, CICC earn global cybersecurity award

- 01/31 12:31 IPOPHL onboards Yamaha Motors in e-commerce pact to combat piracy

- 01/31 11:10 BSP wants new industry protocol for holding of suspicious funds

- 01/31 10:17 Miru System: A major shift in voting technology awaits 2025 elections

- 01/31 05:38 5 more Chinese ‘spies’ nabbed

- 01/31 05:36 Marcos offers China a missile ‘deal’

- 01/31 05:32 Marcos seeks immigration talks with Trump

- 01/31 02:20 ADB sets $500-M loan to boost PH labor market

- 01/30 20:25 PCG pushes Chinese vessel further away from Zambales

- 01/30 16:32 'We shut down everything', Marcos says if SC rules vs 2025 budget

- 01/30 05:50 Philippines, New Zealand start talks on Sovfa

- 01/30 05:44 Elon Musk’s Starlink PH gets boost from House

- 01/30 05:34 2 more Chinese ‘spies’ arrested in Palawan – NSC

- 01/30 04:40 Trash in Manila Bay declined in 2024: How to sustain it?

- 01/30 03:38 PCG conducts hourly radio challenge vs CCG vessel off Zambales

- 01/30 02:26 PH ranks high in downloads, app use

- 01/30 02:18 Gov’t bond forward market coming to PH on Feb 3

- 01/30 02:16 Foreign equity boon to rural banks – BSP study

- 01/29 14:47 Carpio fears PH pact on Ayungin Shoal may expand China’s reach

- 01/29 10:30 Visiting forces agreement talks underway between PH, New Zealand

- 01/29 09:27 OpenAI announces ChatGPT Gov as DeepSeek trend continues

- 01/29 05:55 Maharlika open to buying Chinese stake in NGCP

- 01/29 05:35 2 anti-VP Duterte rallies set for same day, but difference arises

- 01/29 02:10 PH agri sector output down 2.2% in 2024

- 01/29 02:09 Nestlé ready to invest P2B in PH yearly until 2027

- 01/29 02:05 More MSMEs out to brave IPO mart

- 01/28 16:35 DeepSeek: Should you use China’s trending AI chatbot?

- 01/28 15:36 JuanTax, Jaz Philippines launch PH’s 1st AI accounting program

- 01/28 14:51 Army to conduct next phase of US missile system training in Feb

- 01/28 13:15 PH seen stuck in middle income trap until 2050

- 01/28 13:12 West PH Sea: Fewer Chinese ships seen during latest Ayungin resupply mission

- 01/28 09:56 Senate bill to build Special Defense Economic Zone passes final reading

- 01/28 05:45 Filipino wife of detained Chinese: He’s not a spy

- 01/28 05:40 Public warned anew vs side effects of injectable glutathione

- 01/28 05:25 First investment: Gov’t, through Maharlika, gets 20% stake in NGCP

- 01/28 02:11 BSP ramps up efforts vs fraud, cybercrime

- 01/27 17:50 Senate OKs bill granting PH citizenship to Chinese linked to Pogo

- 01/27 09:40 West Philippine Sea: PCG thwarts Chinese ship’s approach in Zambales

- 01/27 05:55 China deploys deafening sonic device vs PCG ship

- 01/27 05:50 DFA: Edca, defense treaty still important to PH, US

- 01/27 05:00 Chapel on site of Edsa Revolt named national shrine

- 01/27 04:40 Teachers set national rallies to demand VP Duterte’s impeachment

- 01/27 02:10 Industry groups warn vs higher beverage, food costs

- 01/27 02:04 Local travel agencies see ‘robust’ year for PH tourism

- 01/26 15:15 PH hits China bid to set a 'new order' in West Philippine Sea

- 01/24 10:59 China renews call to pull out US missile in PH

- 01/24 05:36 AFP checking another sea ‘drone’ found off Bohol

- 01/24 05:30 429-day ordeal ends for 17 PH seafarers held by Yemen rebs

- 01/24 02:32 BSP sharpens framework for probing suspicious accounts

- 01/24 02:30 Subway in Cebu? Feasibility under study

- 01/24 02:20 DigiPlus users surge to 40 million

- 01/24 02:18 Cebu Pacific flights to Masbate, Siargao moving to Clark

- 01/23 21:29 PH vessel prevents Chinese ship from nearing Zambales coast

- 01/23 16:42 DFA vows support in probe of suspected Chinese 'sleeper agent'

- 01/23 11:23 DA eyes partnership with retail chains to expand rice distribution

- 01/23 10:30 AFP investigating reported discovery of underwater drone in Bohol

- 01/23 09:08 ‘Metaverse Filipino Worker’ film features Pinoy digital pioneers

- 01/23 02:28 Rules on sale of ‘small’ state assets out soon

- 01/23 02:24 SteelAsia invests P30B in Quezon plant

- 01/22 23:47 PCG: BRP Cabra takes over to challenge CCG vessels near Zambales coast

- 01/22 17:26 Chinese nationals top getters of employment permit in PH – DOLE data

- 01/22 16:02 CICC launches UnmatchPH campaign against love scams

- 01/22 10:24 PH firms told to boost cybersecurity through AI

- 01/22 10:24 PH firms told to boost cybersecurity through AI

- 01/22 08:44 'America needs us, says PH Ambassador to US amid Trump presidency

- 01/22 07:40 AFP sees links among Chinese spy, recovered drones, falsified PH IDs

- 01/22 05:45 Marcos assures Trump on PH-US alliance

- 01/22 05:20 CSC exec: Not so fast on new gov’t work sked

- 01/22 02:10 Filipino CEOs trust AI, fear skills gap

- 01/22 02:08 US FDA removes coconut from allergen listing

- 01/21 15:18 NSC urges Congress to prioritize anti-espionage bills, amendments

- 01/21 09:57 DA sets aside P85M for small-scale egg production

- 01/21 05:50 Chinese man, 2 Filipinos charged with spying

- 01/21 05:45 Chinese Navy watches PH-US joint drills in WPS

- 01/21 05:30 Banks can’t unreasonably refuse loan payments – SC

- 01/21 02:08 DA sees record-high palay output this 2025

- 01/20 18:57 Philippine real estate outlook remains promising, resilient

- 01/20 17:32 Instagram grid swaps squares for rectangles, disrupting layouts

- 01/20 12:37 Marcos urges Tesla to manufacture electric vehicles in PH

- 01/20 12:02 WPS: PCG radio challenge affects China's 'way of thinking' – exec

- 01/20 11:25 TikTok returns online after Trump promises executive order

- 01/20 05:55 US aircraft carrier joins PH in WPS patrols

- 01/20 05:50 PH to procure 12 more light fighters from South Korea

- 01/20 05:00 DepEd to review sex education program

- 01/20 02:13 Recto: Gov’t might have missed 2024 growth target

- 01/20 02:10 Finland seeks to entice more skilled Filipino workers

- 01/17 05:42 MMDA eyes ‘7-to-4’ work sked in gov’t offices

- 01/17 05:38 Lawmakers: Why Chinese minority shareholder as NGCP chair?

- 01/17 05:36 China’s ‘monster ship' keeps ignoring PH call to leave WPS

- 01/17 05:30 Enrile questions INC ‘logic’ vs VP Sara Duterte impeach raps

- 01/17 02:34 BSP eyes PH shift to coin-lite society

- 01/17 02:32 UAE’s Masdar commits $15-B investment in PH renewable projects

- 01/17 02:20 DoubleDragon eyes P10-B retail bond issuance

- 01/16 10:49 Ransomware incidents increased by 11% in 2024, says Check Point

- 01/16 09:49 Poe asks Senate to probe dismal collection of SSS

- 01/16 09:42 Vatican AI laws: A Catholic approach to tech regulation

- 01/16 05:32 Marcos, Duterte, other execs’ satisfaction ratings down

- 01/16 05:30 A first: Comelec discards 6M ballots costing P132M

- 01/16 02:30 Weaker peso curbed remittances in November

- 01/15 17:18 Whoscall app: The PH had 6 million text scam messages in 2024

- 01/15 11:29 Marcos sympathizes with victims of California wildfires

- 01/15 10:58 Husband held in killing of Filipina in Slovenia, says DFA

- 01/15 05:37 PNP defends self after DILG chief smells ‘conspiracy’

- 01/15 02:18 BMI: Peso fall below 60 vs $1 still possible

- 01/15 02:14 PH vehicle sales hit fresh record high in 2024

- 01/14 19:42 Comelec suspends printing of ballots for 2025 polls

- 01/14 16:05 Contingency plans in place vs China reclamation in Scarborough - Navy

- 01/14 11:42 Marcos still firmly against VP Duterte’s impeachment - Palace

- 01/14 10:26 Credit card skimmers: How to spot and protect yourself against them

- 01/14 10:19 Philippine AI regulations and its high-tech future

- 01/14 05:00 PH, Japan, US confident of growing trilateral ties

- 01/14 02:12 PSEi tumbles to near 7-month low

- 01/14 02:10 SEC tightens disclosure rules on auditor fees

- 01/13 13:59 PH lodges protest vs China for illegal Coast Guard presence in EEZ

- 01/13 11:30 Marcos, Biden, Ishiba pledge stronger trilateral ties in phone call

- 01/13 10:23 WEF says 41% of companies will reduce workforces due to AI by 2030

- 01/13 09:21 How to spot and avoid YouTube comment scams

- 01/13 05:50 DOF: Gov’t not shortchanging LGUs in share of national taxes

- 01/13 05:30 PDIC to hike bank deposit protection

- 01/13 02:09 MVP Group inks 25-year Camp John Hay lease, BCDA’s first

- 01/13 02:07 Renewables dominate pipeline of new power projects in 2025

- 01/12 05:10 EJ Obiena focused on vaulting back to lofty ranking

- 01/10 05:46 BIR: P40B in excise taxes lost due to illicit cigarette, vape trade

- 01/10 05:40 AFP chief: Electing ‘right people,’ not coups, can fix PH problems

- 01/10 05:30 Binays cleared in P1.3-B school ‘overprice’ case

- 01/10 02:30 PH trims trade deficit amid import slump

- 01/10 02:28 BSP eyes shift from digital transaction fees to subscription

- 01/09 23:10 PH ship challenges Chinese vessels off Zambales due to illegal presence

- 01/09 14:43 Comelec: Government aid belongs to Filipinos, not politicians

- 01/09 12:01 NVIDIA Project DIGITS puts an AI supercomputer at your fingertips

- 01/09 11:06 Tech advances, other factors to shape PH labor market until 2030

- 01/09 08:51 Record-high gov’t debt spooks investors

- 01/09 05:50 As ‘monster’ leaves, new Chinese ship takes its place off Zambales

- 01/09 05:32 Gov’t to push for flexible work setups this year

- 01/09 02:28 Peso seen falling below 59:$1 by Q2

- 01/09 02:14 Competition heating up in e-money industry, says BMI research

- 01/08 15:52 9 China Coast Guard vessels patrolling PH EEZ – US maritime expert

- 01/08 14:21 284 HMPV cases logged in PH in 2024; virus mild, not new – DOH

- 01/08 12:08 PH digital lending market seen to exceed $1 billion in 2025

- 01/08 09:17 Facebook, Instagram to ditch fact-checking for community notes

- 01/08 07:17 Open-world games can boost mental health, says study

- 01/08 05:30 ‘Above normal’ rainfall, more typhoons seen January to March

- 01/08 04:40 Many tourists take bus to Baguio amid traffic woes, says mayor

- 01/08 02:10 December inflation sped up to 2.9%, fastest in 4 months

- 01/08 02:05 New high: Gov’t debt topped P16 trillion in November

- 01/07 15:30 Suspected Chinese drone ‘non-operational’ when recovered – Navy

- 01/07 05:55 PH starts temporary hosting of 300 Afghans

- 01/07 05:50 ‘Monster’ still in PH waters, ignores PCG call to leave

- 01/07 05:40 Rights advocates urge US Congress urged to reconsider bill vs ICC

- 01/07 05:00 NSC: No proof yet China behind crashed drone

- 01/07 02:10 John Hay on lockdown as BCDA takes over

- 01/07 02:05 Meralco bags deal to build 600-MW gas plant in Singapore

- 01/06 15:31 NSC restructuring not a sign of rift in security sector – Malaya

- 01/06 13:40 China’s ‘monster ship’ off Zambales an act of aggression – NSC

- 01/06 12:11 New transfer system needed for Filipino prisoners abroad – solon

- 01/06 12:06 BCDA revenues hit P11B in 2024

- 01/06 11:15 PhilRice announces new rice varieties that can lower blood sugar

- 01/06 09:00 How to quit social media for a much-needed digital detox

- 01/06 07:56 PH firms must brace for AI-powered attacks

- 01/06 05:35 More endorsers back 4th impeachment rap vs VP Duterte

- 01/06 05:32 PCG sends ship, 2 aircraft to challenge ‘The Monster’

- 01/06 05:30 US to stay ‘laser-focused’ on PH-China maritime issues

- 01/06 05:25 Opposition mounts vs SSS premium hike

- 01/06 02:10 DBS raises PH GDP growth forecast to 5.8%

- 01/05 19:35 Ex-president also excluded Robredo from NSC – Tañada to Duterte allies

- 01/05 13:42 Rights group calls for ‘greater vigilance’ in 2025, alleges violations

- 01/05 05:41 AFP vows loyalty to flag after Marcos revamp of NSC

- 01/05 05:35 DOST: This smart pen for kids can help tell if they’re troubled

- 01/05 02:15 PH aspires to be next green power paradise

- 01/04 10:03 VP Duterte’s removal from NSC marks intense political conflict – Castro

- 01/04 05:30 BI hunts down 11,000 foreign Pogo workers still in PH

- 01/04 02:10 New year, new jets for rich Filipinos

- 01/03 16:09 Chinese embassy in PH dismisses rumors of new disease outbreak in China

- 01/03 14:57 Marcos reorganizes NSC, removes VP as member due to irrelevance

- 01/03 13:47 Oreo maker Mondelez uses AI to create new snack flavors

- 01/03 10:00 DOH verifying alleged 'international health concern'

- 01/03 08:36 BI: 22,609 Pogo workers leave PH; 11,000 others for deportation

- 01/03 07:47 China develops a self-lightening backpack

- 01/03 05:40 ‘Chinese’ drone retrieved from Masbate waters piques Navy

- 01/03 05:19 As PBA enters 50th year, will four-point shot stay?

- 01/03 02:14 SEC drafts rules on crypto services

- 01/03 02:12 DigiPlus secures Brazil license

- 01/02 10:56 Filipino scientists made concrete blocks with coffee grounds

- 01/02 05:38 OSG: Pogo asset seizures, birth records purge next

- 01/02 05:32 Northern Luzon at risk of more quakes

- 01/02 05:25 PH ambassador to Hungary is latest Marcos appointee

- 01/02 05:21 Ecozone eyed as naval base site in Mindanao

- 01/02 02:15 IMF asks BSP to disclose info on balance sheet strategy

- 01/02 02:10 1st round of PH-Chile FTA talks set for March

- 01/01 22:45 Marbil vows ’tech-driven, apolitical’ PNP in 2025

- 01/01 18:15 PH Ambassador Romualdez to attend Trump inauguration – Palace

- 01/01 05:39 Budget critics: Veto still left ‘pork’ intact

- 12/31 12:06 OCD gears up for another Mt. Kanlaon eruption

- 12/31 05:40 Vice, gore: A peek into the sinister world of Pogo traffickers

- 12/31 05:35 Panfilo Lacson to gov’t: Brace for legal challenge vs 2025 budget

- 12/31 02:08 An upper middle-income nation by 2025? What PH is bound to lose

- 12/31 02:02 Philippine telcos ramp up cybersecurity efforts

- 12/30 14:56 ‘Broken from start’, UniTeam sees complete collapse

- 12/30 13:07 Marcos pays tribute to late former US President Jimmy Carter

- 12/30 09:33 Marcos signs P6.3 trillion 2025 national budget, vetoes P194 billion

- 12/30 05:20 Filipino booters look to clinch a first-ever Asean Cup finals berth

- 12/30 02:30 PH home prices contract for first time in 3 years

- 12/30 02:28 PH attracts net ‘hot money’ inflow of $96.59M in Nov

- 12/24 21:09 Watch out for crypto scams this Christmas – CICC

- 12/22 05:50 BFAR plane tells Chinese Navy: ‘Review your chart!’

- 12/22 05:38 AFP trusts President Marcos, system, says Brawner

- 12/22 05:30 Marcos, VP Duterte ratings down as poll reflects inflation woes

- 12/22 02:22 Woke but confused: Holidays leave adulting Filipinos financially bipolar

- 12/20 10:37 6 power projects endorsed for operating permits

- 12/20 05:52 Marcos: Let DOJ handle House move vs Rodrigo Duterte

- 12/20 05:48 PNP partners with TikTok vs online scams, exploitation

- 12/20 05:42 SC fires judge involved in wife’s illegal deals

- 12/20 05:34 3rd impeach rap filed vs VP Duterte; Leni Robredo ally an endorser

- 12/20 05:04 Golf club members join legal battle in Camp John Hay

- 12/20 02:24 Balance of payments deficit grew to widest in over 2 years

- 12/19 16:06 Sovereignty, accountability, and hope: Key Philippine stories of 2024

- 12/19 13:47 Blueleaf ramps up Laguna floating solar deployment

- 12/19 09:39 PH bracing for foreign bond comeback in H1 2025

- 12/19 09:22 Vietnam learns lesson about China aggression – everyone’s a target

- 12/19 05:42 8,000 foreign Pogo workers still in PH with tourist visas, says BI

- 12/19 05:30 House tags Duterte, et al. for ‘crimes against humanity’

- 12/19 04:32 ‘Decarbonizing’ PH a race against time – but ‘we should do it properly’

- 12/19 02:28 Marcos-Duterte clash to hurt economy – Fitch

- 12/19 02:12 Holiday online shopping fraud ‘alarmingly high’ in PH

- 12/18 12:58 Neda Board approves issuance of EO on PH-Korea free trade deal

- 12/18 10:13 Blockchain Game Alliance Report shows organic Web3 gaming growth

- 12/18 09:34 DepEd budget expose billions in unspent funds

- 12/18 09:12 Prisoner swap pacts with other nations eyed after Veloso’s return

- 12/18 05:50 House OKs bill that lets foreigners lease land for 99 years

- 12/18 05:10 PhilHealth P500-B fund investment questioned

- 12/17 14:13 DTI revising regulations for vape products

- 12/17 12:25 AFP: Yearend WPS resupply, Noche Buena delivery missions successful

- 12/17 10:05 Peza expects approved investments to rise by 10% in 2025

- 12/17 09:56 Shadowy uranium trade reaches PH, raises fear of ‘dirty bomb’

- 12/17 05:45 COA: 4,000 dead seniors still on PhilHealth database

- 12/17 05:35 SC: Suspension of single, pregnant teacher illegal

- 12/16 18:23 Marcos on current state of PH: We’re quite stable amid political noise

- 12/16 05:33 Island Cove’s jobless: The other side of the Pogo ban

- 12/15 17:47 Dolly de Leon says a celeb’s craft deserves more focus than personal life

- 12/15 05:50 Senate bill forfeits illegal Pogo assets in favor of gov’t

- 12/15 05:25 DBM opens e-market for gov’t suppliers

- 12/15 02:03 Engineers build innovative roof manufacturing business

- 12/14 09:25 AI solar boat cleans 2.5 million liters of river water daily

- 12/14 08:40 AI agents will become brand ambassadors in 'Agentic Era' – study

- 12/14 05:55 House panel: Ex-president Duterte center of grand criminal enterprise

- 12/14 05:30 SMNI duo ordered to pay TV journalist P2M in damages

- 12/14 04:40 Negros Occidental declares state of calamity after Kanlaon blast

- 12/13 12:48 Harvard opens access to 1 million books for training AI models

- 12/13 12:21 Marcos aims to make PH military a 'world-class force'

- 12/13 11:39 Philippines deports 2,300 Pogo workers to China, other Asian countries

- 12/13 10:01 Gov’t eyes more diversified external financing before losing ODA perks

- 12/13 08:55 Teacher uses this trick to check students’ AI homework

- 12/13 05:30 Seized Pogo properties pose next gov’t challenge

- 12/13 02:32 It’s final: BCDA regains control of John Hay

- 12/12 22:14 2 more PH nature reserves tagged of ‘international importance’

- 12/12 10:59 VP Sara Duterte wrong in saying DOJ is ‘biased’ in probing her – exec

- 12/12 09:14 AI’s real impact on the global economy

- 12/12 05:48 Fisherfolk to SC: Void Manila Bay reclamation works

- 12/11 17:30 VP Sara Duterte considering hiring private security force

- 12/11 15:09 Local identity fraud cases surged 119% this year — study

- 12/11 14:24 DA bans poultry from The Netherlands

- 12/11 14:10 PDEA raises alarm over marijuana's growing popularity as holidays near

- 12/11 11:38 Marcos vows to make overseas work a choice, not a necessity

- 12/11 11:14 Readers more likely to distrust news from AI articles – study

- 12/11 07:32 Pogo phaseout in full swing; only 17 remain

- 12/11 05:55 Marcos rules out warship deployment in West Philippine Sea

- 12/11 02:04 World Bank trims PH growth outlook

- 12/10 15:34 China’s acts of war in West PH Sea accelerating ecological ruin

- 12/10 10:18 LTO vows stricter regulation of motorcycle taxis

- 12/10 05:50 Secret fund use hits P10B; OVP outspends 4 security agencies

- 12/10 05:45 Over 100 kilos of uranium seized in Pasay, CDO and Mandaue

- 12/10 04:40 Thousands evacuated as Mt. Kanlaon erupts anew

- 12/10 02:11 PH emerges as hot spot for RE investments

- 12/09 08:00 105 y.o. saved from stroke through advanced procedure in The Medical City

- 12/09 05:55 Chinese vessel hits BFAR ship with laser six times

- 12/09 05:50 Kalookan bishop, drug war critic is PH 10th cardinal

- 12/09 04:35 Eastern Samar has ‘fastest’ economic growth in Eastern Visayas

- 12/08 02:04 Demand for first-class seats rising among Filipino jetsetters